Wire Fraud Is Targeting Homebuyers and Sellers – and Most Don’t Even Know It’s Happening

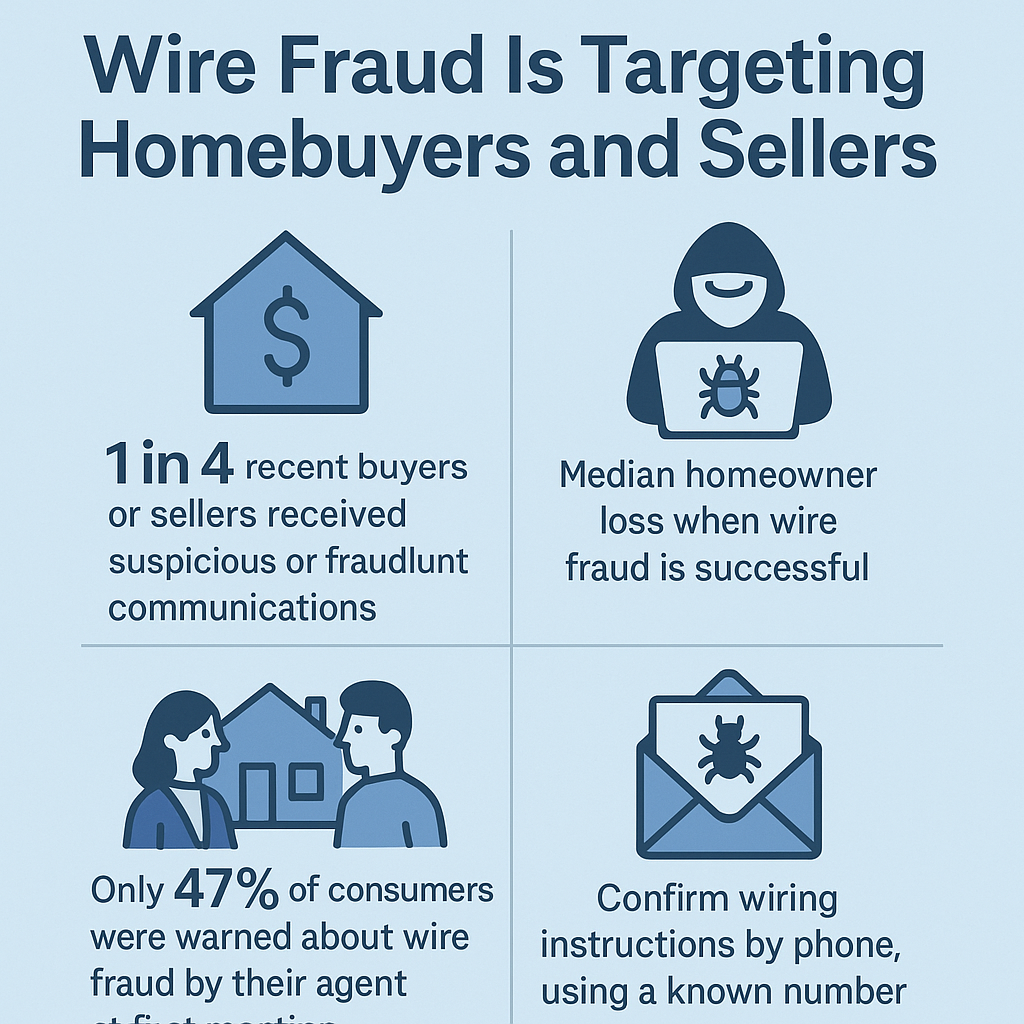

If you’re buying or selling a home in 2025, there’s one threat that’s flying under the radar but has the potential to wipe out your life savings in seconds: wire fraud. According to the just-released State of Wire Fraud 2025 report by CertifID, 1 in 4 consumers reported receiving suspicious or fraudulent communications during their real estate transaction, and nearly 1 in 20 became actual victims.

The numbers are staggering. In 2024, real estate wire fraud resulted in nearly $500 million in losses due to business email compromise (BEC) scams, where criminals impersonate trusted professionals like real estate agents, title officers, or lenders. In fact, the most impersonated party in these scams? The real estate agent – mentioned by 58% of victims. Next up was the title agent (41%) and then loan officers (34%), even though they typically aren’t involved in wiring funds.

And it’s not just tech novices falling for this. According to the survey, first-time buyers and sellers were 3x more likely to become victims than experienced ones. That makes sense when you consider how complex, unfamiliar, and urgent real estate closings can feel – especially when you’re wiring six figures and just trying to hit a tight deadline.

Even more troubling? Most people still don’t even know this is a risk. Over half (52%) of home buyers and sellers said they were “not aware” or only “somewhat aware” of wire fraud risks before their last closing. And only 49% were educated about wire fraud by their real estate professionals – which is a problem, considering buyers expect their agent to help protect them.

Here’s what this actually looks like in practice: a West Virginia homebuyer lost $112,000 after wiring funds to a fraudster posing as her closing agent. As she put it, “The way the person did it – it was really, really good.” These aren’t sloppy scams. They’re sophisticated, often powered by AI-generated emails, spoofed phone numbers, and exact timing. Once that money is gone, there’s no guarantee it’s coming back. Only 73% of victims in the report recovered all or most of their funds. The rest – 27% – lost half or more, or everything.

So who’s responsible for stopping this?

That depends on who you ask. Consumers surveyed were almost evenly split: 30% said their real estate agent should protect them from fraud. Another 30% said their bank, and another 30% pointed to their title company or attorney. But the reality is, in most transactions, no one party owns the full responsibility – and that’s part of the problem.

What’s clear from this report is that education is the first line of defense, and it’s still not happening early or consistently enough. Most buyers and sellers who got educated on fraud didn’t hear about it until mid-process or even right before closing. But by then, a scammer may already be in their inbox.

CertifID’s analysis of 2024 cases found that:

- Median loss from buyer-side wire fraud was $68,413

- Seller-side wire fraud averaged $172,080

- Mortgage payoff fraud averaged a staggering $275,927

Technology alone won’t fix this, but the right tools can help. According to the report, CertifID verified over 913,000 transactions in 2024 and identified $1.32 billion in high-risk transfers that were successfully stopped before funds were lost.

The takeaway here is simple but urgent: if you’re planning to buy or sell a home, take wire fraud seriously. Assume your communications can be spoofed. Don’t trust last-minute wiring instructions that come via email or text – verify them by phone, using a number you’ve independently confirmed. Ask your agent and title company how they protect your transaction. And don’t wait until the week of closing to start asking questions.

In a market where transactions already feel harder than ever, the last thing anyone needs is to lose their home… and their money… to a scam.

📘 You can access the full 2025 State of Wire Fraud report from CertifID below. It’s worth reading — especially if you’ve got a closing coming up: