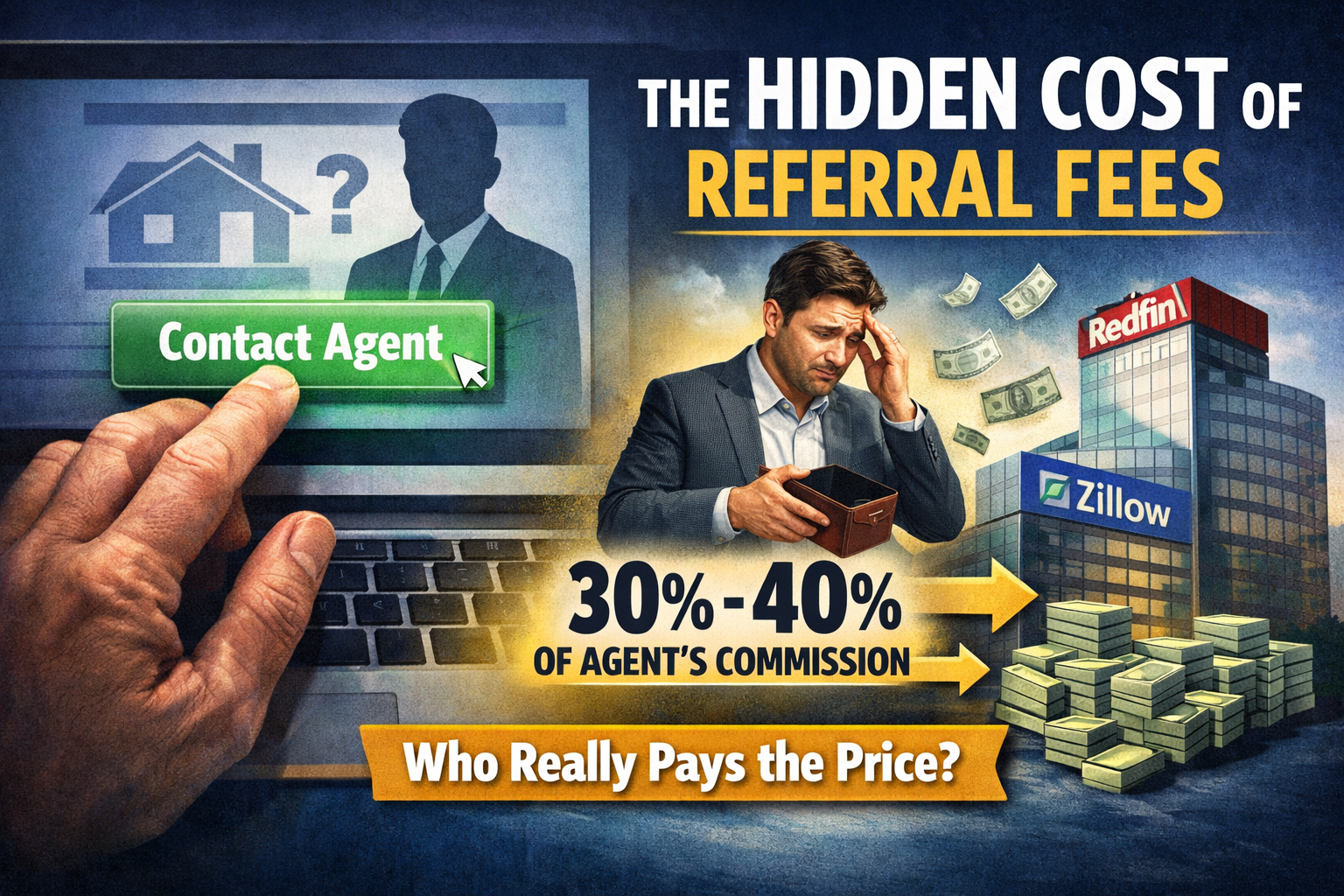

If you’re a homebuyer, there’s a good chance you’ve clicked “Contact Agent” on a portal and assumed you were simply being connected to a local professional. What many consumers don’t realize is that behind that click, there is often a 30% to 40% referral fee being paid out of the agent’s commission.

According to a February 2026 report from the Consumer Policy Center titled Commission-Based Home Referral Services: Consumer Impacts and Proposed Reforms , these referral fees have become a major revenue source for portals and referral platforms. In many cases, the buyer’s agent is paying 30% to 40% of their commission to the company that supplied the lead. Zillow, for example, commonly charges 40% on many transactions. Redfin’s partner fees range into the 30% to 40% range as well.