Real estate investors sold nearly 11% of all homes nationwide in 2024—the highest share in over two decades of tracking, according to Realtor.com’s latest investor report. That figure represents over 500,000 homes sold by investors last year alone. But unlike the investor selloffs we saw during the housing boom, this time it’s not about taking profits—it’s about stopping the bleeding. With rental prices cooling and returns tightening, investors are repositioning fast.

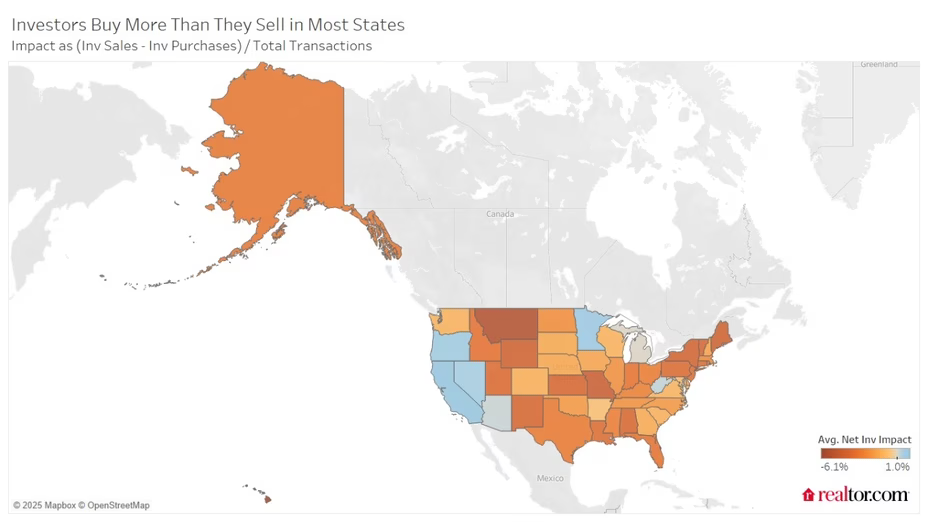

The shift is visible in the numbers. While investor buying slowed slightly compared to 2021 and 2022, the drop in sales volumes didn’t mirror that pace. Instead, more investors decided to exit, particularly in states where home values have flattened or rent growth has stalled. The map below tells the story—investors are still net buyers in most states, but the gap between what they’re buying and what they’re offloading has narrowed significantly.

The biggest increases in investor selling came from traditionally strong rental markets in the South and Midwest. Missouri, Oklahoma, Georgia, Kansas, and Utah all landed in the top five for investor sellers. Those same states also led in investor purchases. Why? They strike a balance, home prices that are affordable compared to national averages, and rents that still offer a decent return. But even in those areas, some investors are signaling it’s time to pull back, suggesting a cautious outlook for 2025.

Whether this trend marks a temporary adjustment or a longer-term strategic shift remains to be seen. But one thing is clear: the investor calculus has changed, and for those watching market dynamics from the ground, this movement could reshape inventory and pricing pressures across multiple U.S. markets.