Zillow’s Court Filing Pulls Back the Curtain on Its Real Estate Model

A recent court filing in Zillow’s legal dispute with Compass revealed more than just legal strategy — it gave a rare window into how Zillow sees its role in the real estate ecosystem. And if you read between the lines, the message is clear: Zillow may dominate in traffic, but it’s far from the gatekeeper many agents or consumers assume it is.

Buried in Zillow’s opposition to a preliminary injunction was a candid acknowledgment of how their platform actually works — and where its limits lie.

“Zillow must continuously win over consumers with a high-quality experience because its competitors can access the same data feeds by becoming a licensed brokerage and joining the MLS.”

In other words, Zillow doesn’t control the listing inventory. It gets data from MLS feeds just like anyone else with a brokerage license. That means your local IDX website, your broker’s app, and Zillow are often showing the same properties — just with different branding and user experience.

The company’s value proposition isn’t exclusivity. It’s visibility. That’s why Zillow’s newly implemented Listing Access Standards are so important to them. These standards state that any listing that’s publicly marketed must be in the MLS within one business day to appear on Zillow or Trulia. Zillow positions this as a pro-consumer move — an effort to maintain trust by keeping listings current, accessible, and complete.

But perhaps the most telling statement from Zillow’s filing is this:

“Many of the same for-sale listings that Zillow displays are available on Compass’s website, Homes.com, and Realtor.com… Many consumers also use other home search platforms.”

Translation: Zillow knows buyers are shopping around. Their market share is measured in eyeballs, not closings. They openly admit that a large portion of their user base isn’t even in the market to buy — they’re dreaming, browsing, or researching. Serious, ready-to-transact buyers are a smaller subset, and Zillow has to compete hard for their attention.

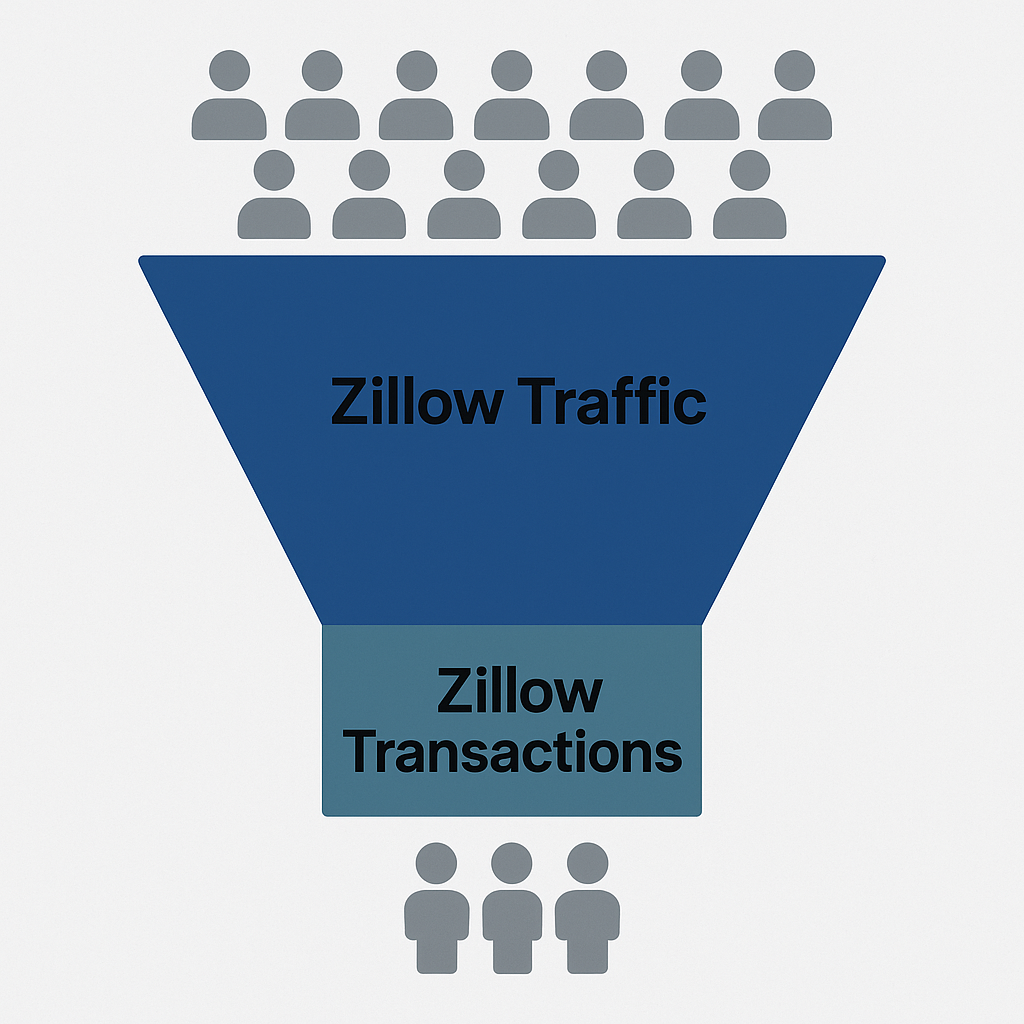

In fact, despite reportedly serving 64–66% of online real estate shoppers, Zillow only facilitates a single-digit percentage of actual residential sales. That’s a massive funnel with a tiny spout.

So what does all this mean for agents and consumers?

For agents: Paying for exposure on Zillow doesn’t guarantee exclusive leads or conversions. If you’re not focused on follow-up and relationship-building, Zillow is just an expensive billboard.

For consumers: Don’t assume you’re seeing “everything” on Zillow. It’s a great research tool, but it’s not the only one — and not every property may show up if it doesn’t meet Zillow’s data or access requirements.

Zillow’s defense against legal claims may play out in court, but in the process, they’ve offered the industry a valuable reminder: their influence is driven by perception, not ownership. They don’t control the market — they compete in it, just like everyone else.