There’s a familiar pattern playing out across industries right now, and real estate agents are right in the thick of it, whether we realize it or not.

The research on Amazon and Uber’s fee evolution is eye-opening. Both platforms started by offering their users, sellers and drivers, low-cost access and the promise of big opportunities. Amazon took less than 10% from sellers back in 2006. Uber’s original commission rate was a flat 20%. Fast forward to 2025, and Amazon is taking roughly 45% of third-party sellers’ revenue. Uber drivers are seeing 30 to 40% of their fares siphoned off in fees.

So what’s this got to do with residential real estate agents?

Quite a bit.

Because we’re watching a similar “platform creep” unfold in our own industry. Think about how much of today’s buyer lead activity originates on portals like Zillow, Realtor.com, and others. And now think about how they get that inventory in the first place: agents and brokers uploading their listings to MLSs, which feed these platforms in near real time. It’s our own data, our stock in trade, that powers the system.

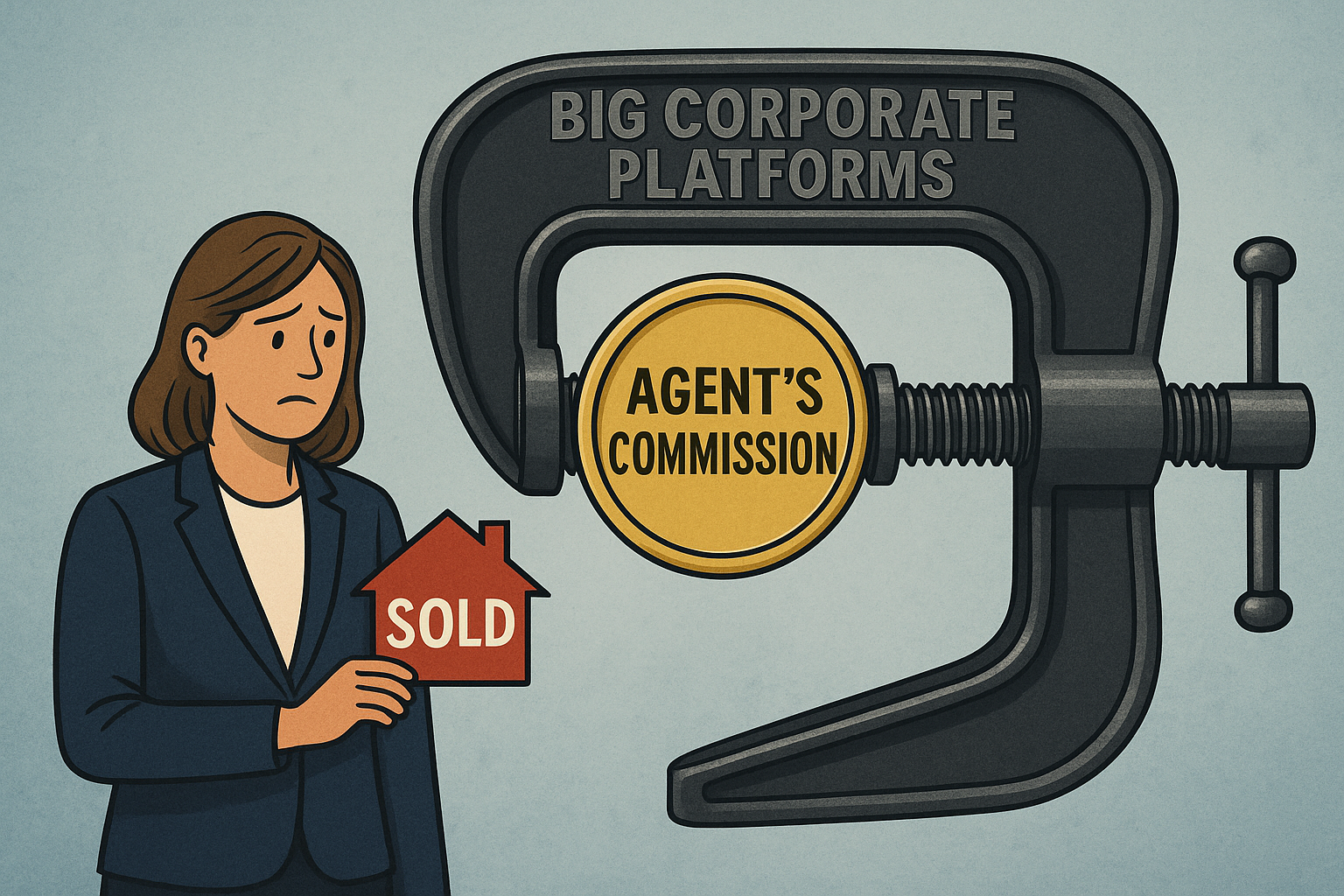

But now, if an agent wants a shot at connecting with the buyer these platforms attract using our own listings, there are fees… sometimes huge ones.

Many agents pay monthly for advertising or premier agent status. Others are paying referral fees north of 35 to 40%—numbers not far off from Amazon’s or Uber’s cut. The irony is, we’re paying to access leads that, in many cases, originated because we provided the listing data in the first place.

It’s the same playbook: attract users with low or no cost, build network effects, then tighten the screws once switching costs get high and alternatives get thin. Just like Amazon’s sellers or Uber’s drivers, many agents now feel like we have no choice. If you’re not playing the game, paying to play, you risk being invisible.

This isn’t about “Zillow bad, MLS good” or any of the usual industry drama. It’s about recognizing the shift. These platforms are no longer just marketing partners, they’re marketplaces with increasing leverage. And they’re charging us to stay in the game we helped them build.

We’ve seen where this road leads. Sellers on Amazon and drivers on Uber aren’t making more… they’re making less, even as the platforms keep growing. That’s the risk here too. The more intermediaries take a cut between agents and clients, the less margin there is for the professional doing the actual work.

It’s probably time we ask some hard questions. Are we comfortable with where this is going? Do agents, brokers, and associations have a plan for preserving long-term value and independence? Or are we just going to keep feeding the machine, hoping it stays friendly?

Because history tells us… it won’t.