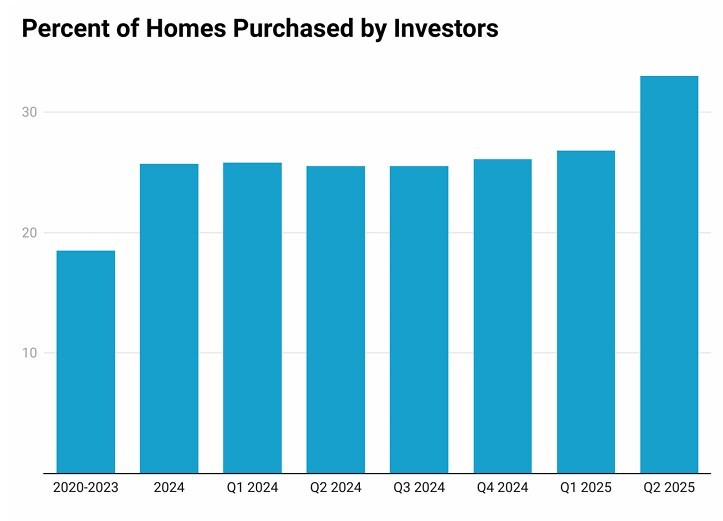

According to the Q2 2025 Investor Pulse™ Report from BatchData, investors accounted for 33% of all single-family home purchases in the U.S., the highest share in five years. That jump from 27% in Q1 might sound alarming to some, but the full picture is a bit more nuanced. Yes, investors bought one-third of the homes sold last quarter, but who those investors are, and what they’re buying, is the more important story.

Despite headlines often pointing fingers at Wall Street firms, it’s the “mom-and-pop” investors driving this trend. BatchData’s report shows that individuals owning one to five properties make up a staggering 87% of investor-owned single-family homes nationwide. When you include those holding up to 10 properties, that number jumps to 91%. The big institutions? They own just 2% of investor-held homes and have been net sellers for six quarters in a row. In Q2, they sold 5,801 homes while only buying 4,069.

What’s also notable is that these small-scale investors are focused on value. The average price paid in Q2 was $455,481, well below the national average of $512,800. Institutional buyers paid even less, averaging just under $280,000 per home. This tells us most investor activity is still centered on more affordable homes in secondary markets or regions with higher rental yield potential, not high-end or luxury homes.

If you look at the chart below showing the Percent of Homes Purchased by Investors, you can clearly see the upward trend over the past five quarters. After hovering just under 26% throughout 2024, investor share climbed steadily in 2025, peaking at 33% in Q2. While that percentage is high, the actual number of investor purchases dropped by 16,000 from a year ago. That means a soft resale market, not runaway investor buying, is what’s pushing the share higher. For anyone watching the market, especially agents working with first-time buyers, it’s critical to understand that while investor influence is growing, it’s primarily being driven by thousands of individual owners, not corporate landlords.