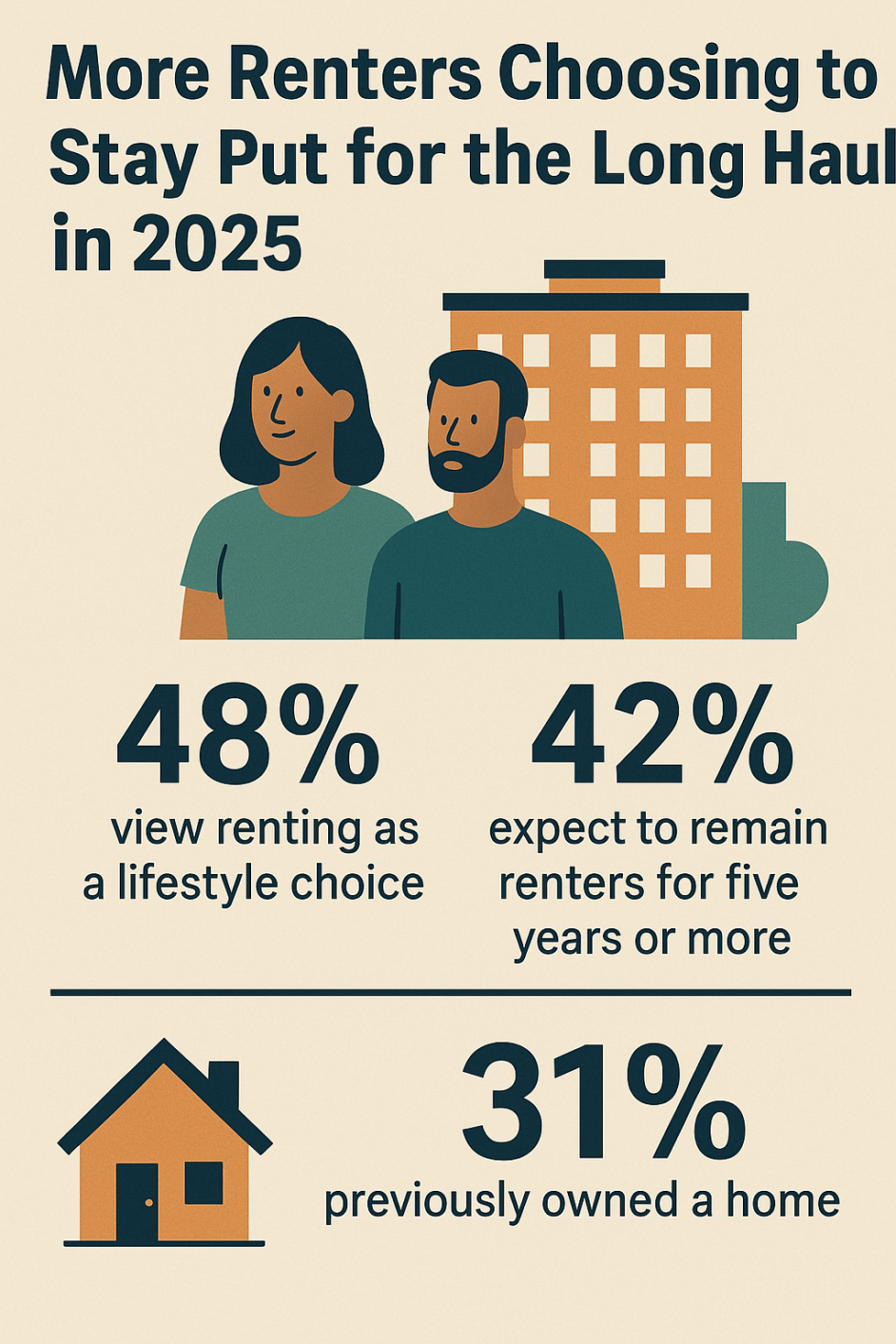

Knightvest Capital’s 2024–2025 Multifamily Renter Sentiment Report highlights a continued shift in attitudes around homeownership—and it’s a shift that works in favor of rental property investors. According to the report, nearly half of renters surveyed (48%) are choosing to rent rather than feeling forced into it, and 42% say they now view renting as a long-term living arrangement.

Affordability still tops the list of reasons people rent, with 63% citing the high cost of buying a home. But other factors are playing a growing role, including reduced maintenance responsibilities (59%) and flexibility to relocate (34%). Interestingly, about one-third of those surveyed previously owned a home, which reinforces that the preference for renting isn’t always about cost—it’s increasingly a lifestyle choice.

Knightvest’s report also notes a shift in how renters respond to market pressures like interest rates. In 2024, 70% of renters said they’d consider buying if rates dropped; in 2025, that number dipped to 60%. That suggests renters aren’t hanging on the Fed’s next move—instead, many are leaning into renting as the more stable, predictable option.

Proximity to work remains a key driver. Among those who work full-time in an office, 85% said location and commute times affect their housing preferences. This will continue to influence multifamily demand, particularly in urban and job-centric markets.

One other takeaway that should catch investors’ attention: the financial bar to homeownership keeps rising. Millennials now estimate they need a salary of $134,000 to afford the home they want, while Gen Z reports needing $135,000. That disconnect between income and housing costs will likely keep rental demand strong, especially in high-growth metros.