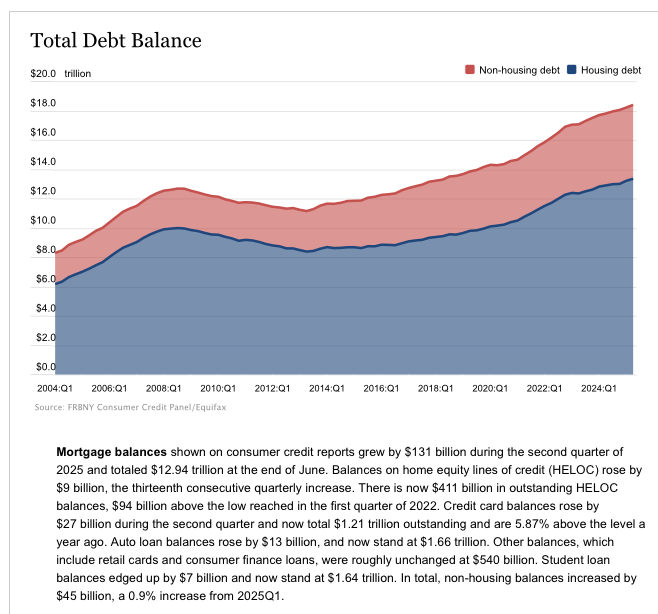

In the second quarter of 2025, household debt across the U.S. soared to an eye-opening $18.39 trillion—up by $185 billion in just three months. What’s driving this surge? A couple of key areas stand out, and homeowners and buyers alike should take notice.

Mortgages led the charge, climbing by $131 billion, pushing total mortgage debt to a hefty $12.94 trillion. Interestingly, despite rising rates and affordability challenges, new mortgage originations ticked slightly upward, signaling that buyer demand remains resilient.

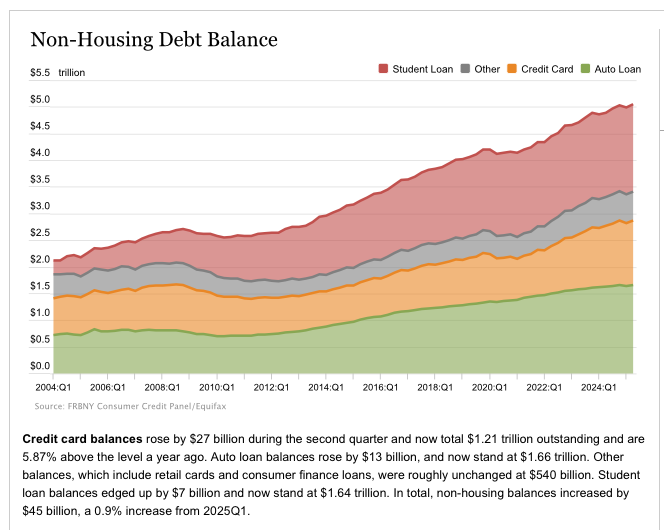

But it’s not just housing fueling this debt climb. Auto loans continued their steady climb, reaching $1.66 trillion, up by $13 billion in a single quarter. On top of this, Home Equity Lines of Credit (HELOCs)—increasingly popular for homeowners tapping equity amid high-interest rates—rose yet again, marking their 13th consecutive quarterly increase, now totaling $411 billion.

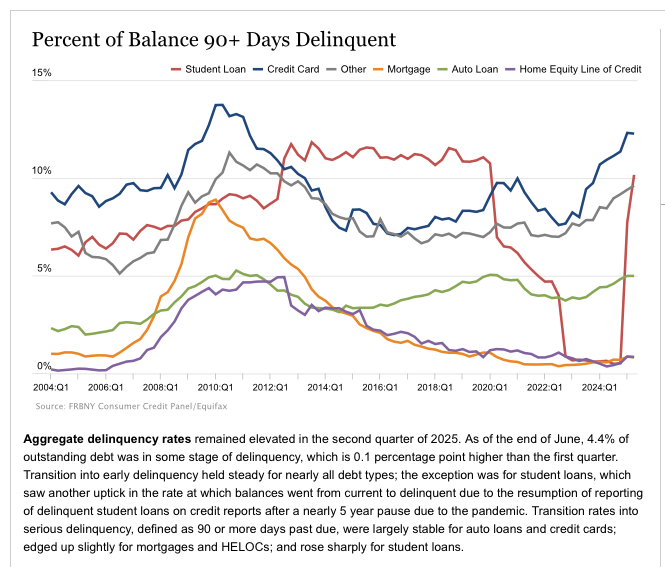

Yet, the caution flag is clearly waving for delinquencies. Overall, delinquency rates remain elevated, hitting 4.4%. Notably, student loans are seeing more borrowers slipping into delinquency, likely due to the resumption of regular reporting after pandemic-era pauses. Credit card balances also surged to $1.21 trillion, now nearly 6% above where they stood a year ago, indicating consumers might be stretched thin.

So, what’s the takeaway? For homebuyers and homeowners, the continued rise in debt underscores the importance of balancing opportunities—like home equity—with the risks of taking on new financial burdens. Staying financially informed and vigilant could make all the difference as the market evolves.