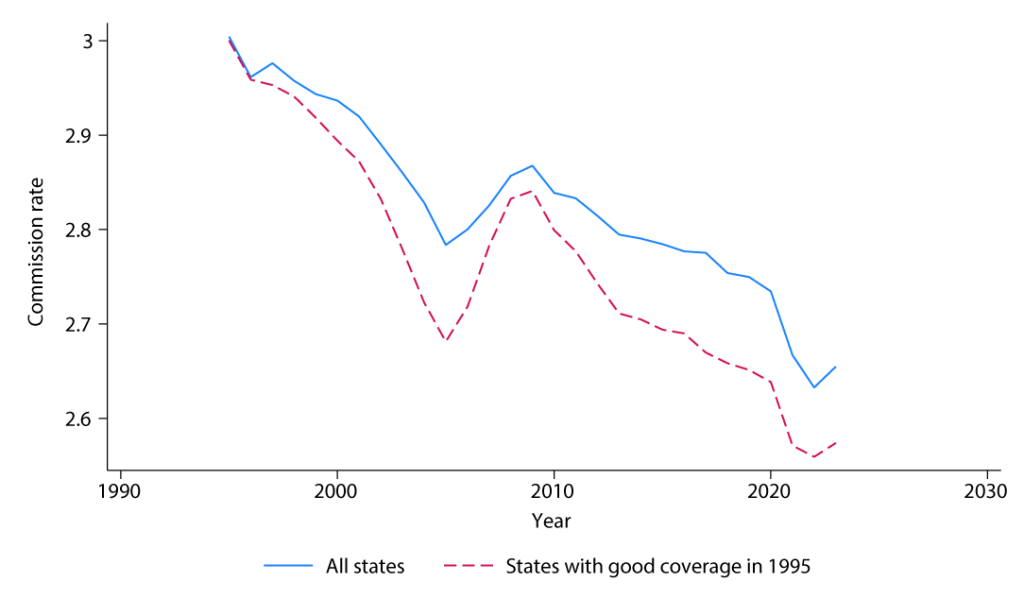

The Fed’s new report takes a deeper look at commissions just as the industry is adjusting to the fallout from the $418 million NAR settlement. That settlement banned listing offers of compensation to buyer’s agents and required written agreements spelling out how buyer agents will be paid. A lot of folks expected this to push commission rates lower fast, or even shake up the business model. But so far, the data says otherwise. Nationally, buyer agent commissions have only dipped slightly over the past couple of decades, from about 3% to 2.7%, and most of that change happened long before the rule shift.

What’s more, the Fed found that policies like buyer agency agreements and rebate bans didn’t do much to move the needle. The bigger driver seems to be local custom and home prices. Areas with higher home values tend to have lower percentage rates, but the traditional split is still common in many places. The big question now is whether buyers, when asked to agree upfront to pay their agent, will start questioning the value more directly. If that happens, we might finally see some real changes to how agents get paid.

Average Buyer Agent Commission Rate Over Time