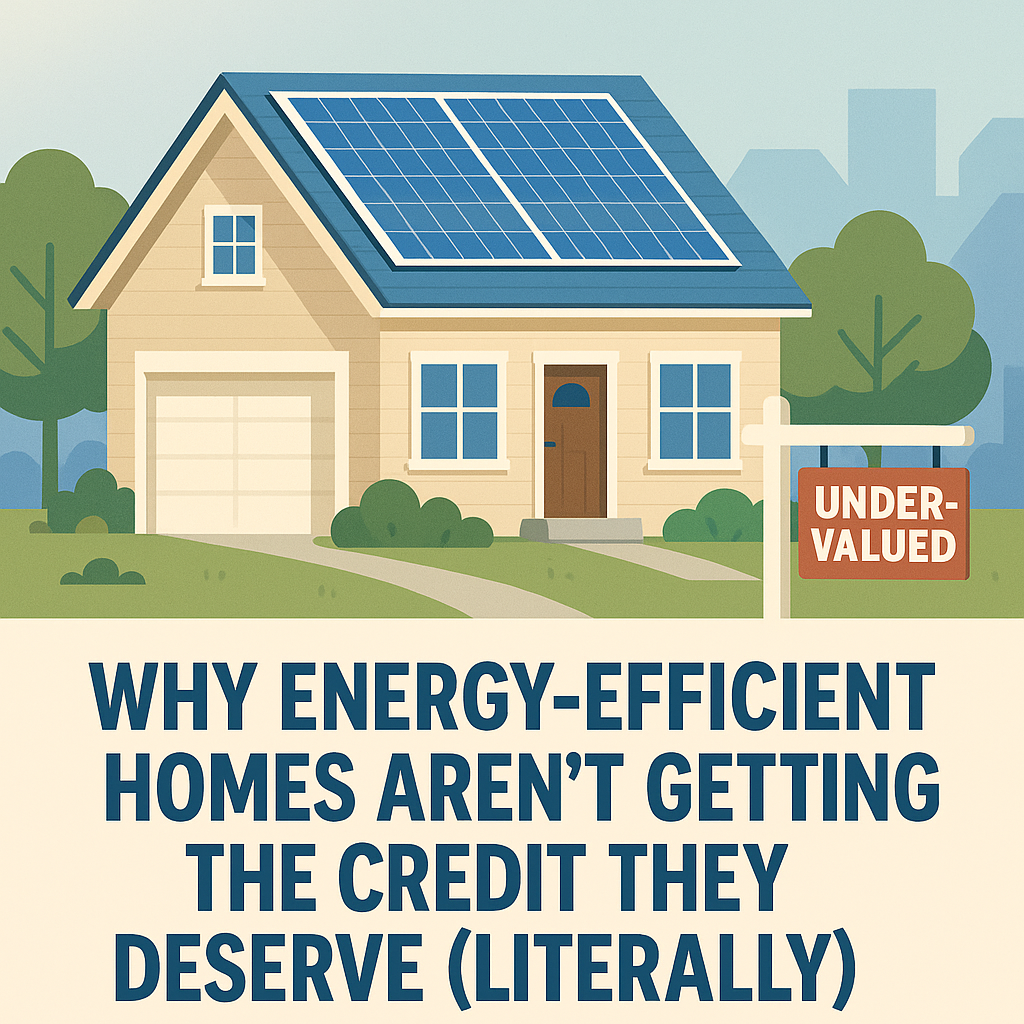

The market seems to be pushing for sustainability, but the system still hasn’t caught up. That disconnect is creating real issues for buyers, sellers, and agents.

According to the National Association of REALTORS® 2025 Residential Sustainability Report, nearly half of the agents surveyed said they’ve worked with a green-featured home in the past year. Yet, 73% aren’t even sure whether local appraisers know how to value those features properly. If solar panels, high-efficiency systems, or smart home upgrades don’t show up in the valuation, the seller doesn’t benefit and the buyer may not realize what they’re getting.