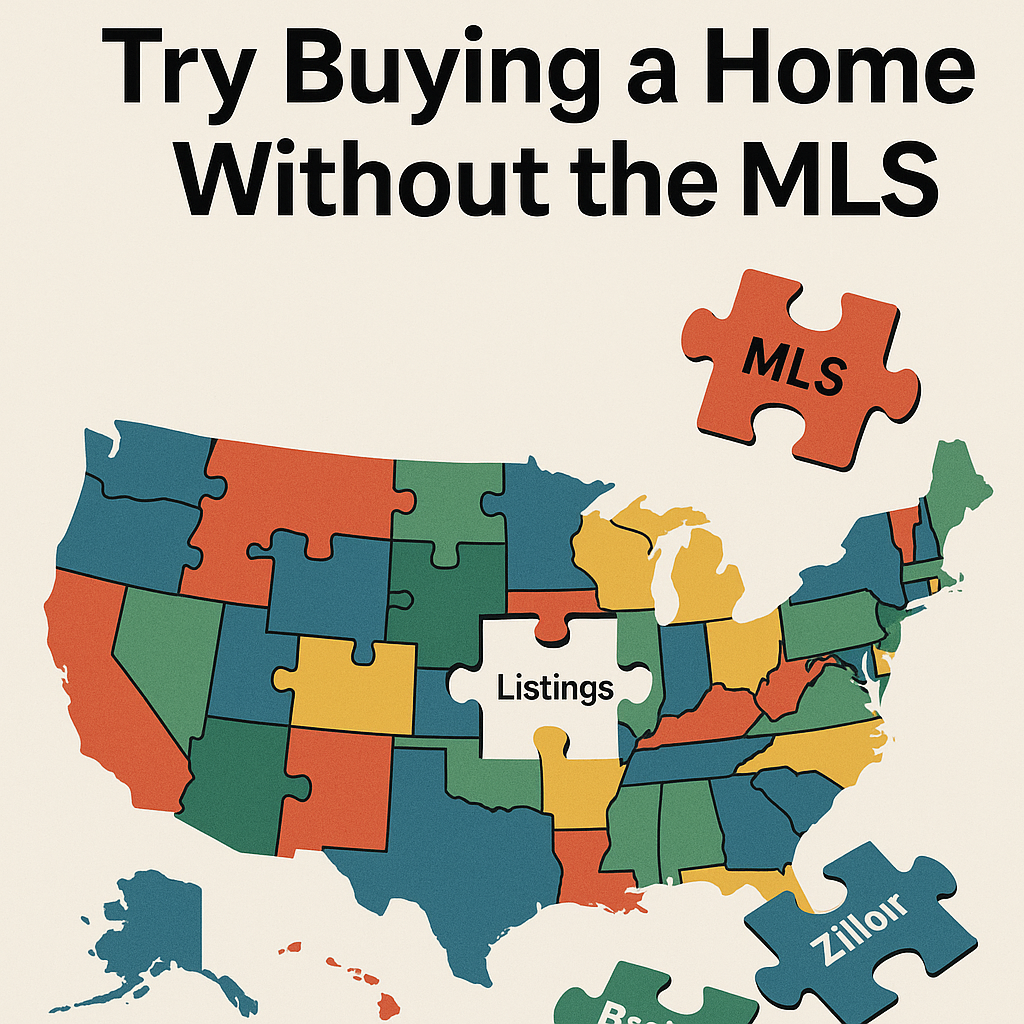

Think the American housing market is a mess? Try buying a home in Europe.

In a recent Business Insider article, James Rodriguez recapped real estate executive Brian Boero’s frustrating experience buying a second home in Italy, a process that felt like, in Boero’s words, “feeling around in the dark.” No reliable listing portal, no pricing consistency, and no central database. Just window shopping (literally) and chasing down agents who may or may not know what’s actually for sale.