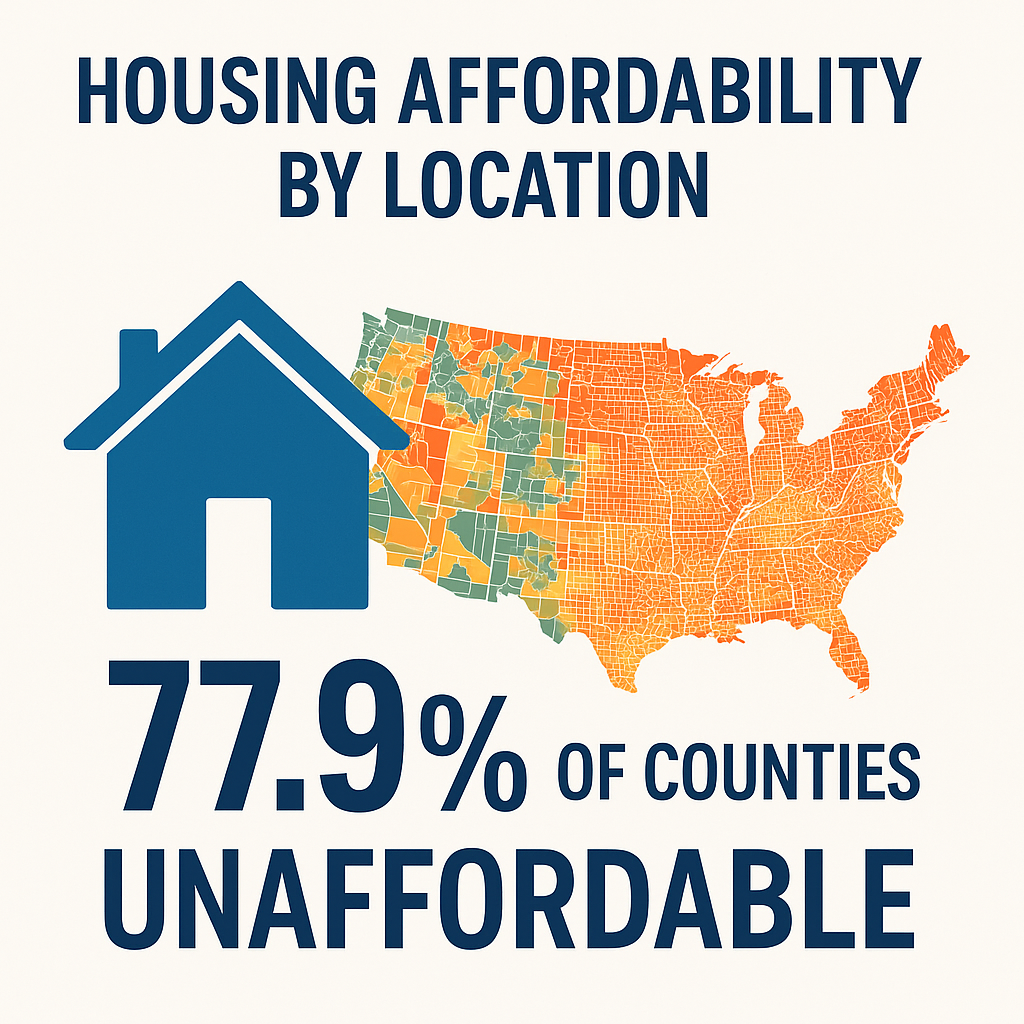

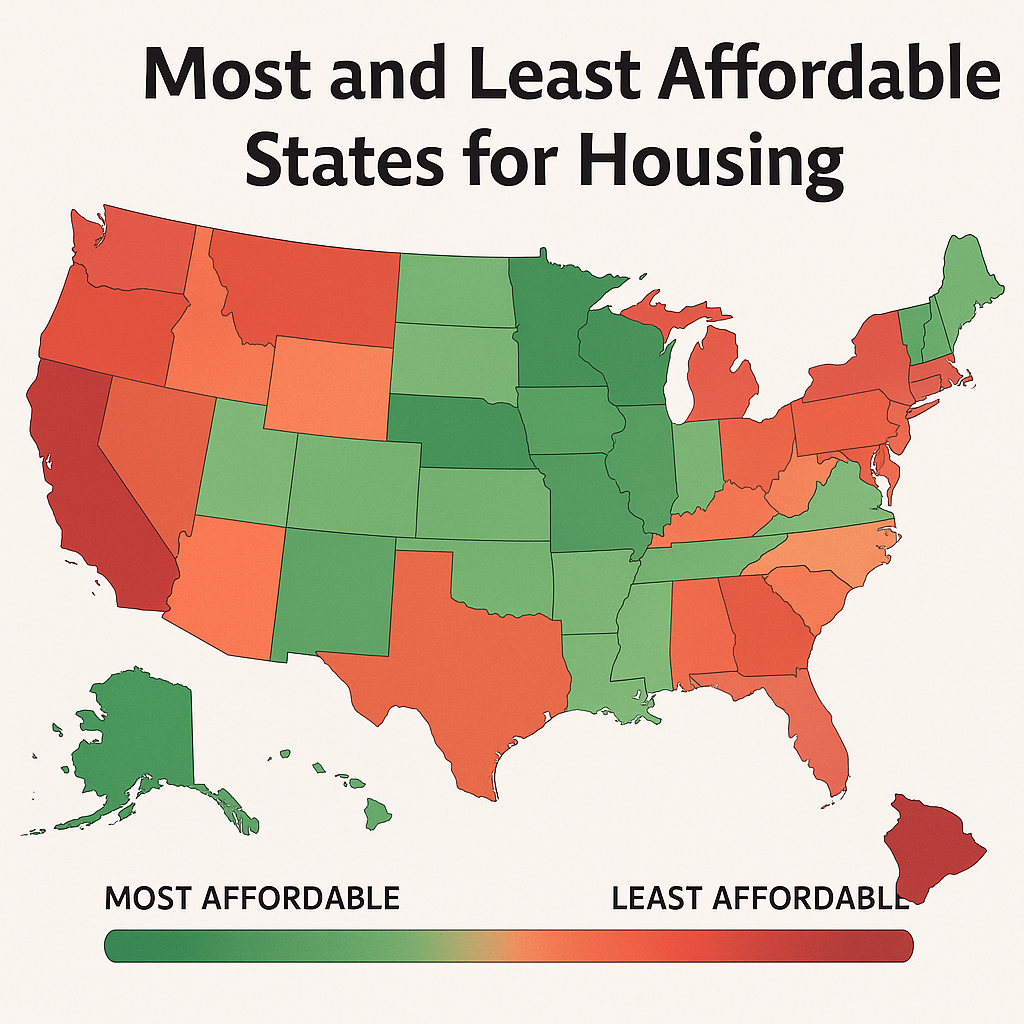

When it comes to housing affordability, location isn’t just important, it’s crucial. ATTOM Data Solutions’ latest U.S. Home Affordability Report reveals that in the second quarter of 2025, homeownership expenses were unaffordable for typical residents in 77.9% of counties across the country. Nationally, the median home price rose to a historic high of $369,000, requiring average earners to dedicate 33.7% of their income, well above the recommended maximum of 28%,towards housing expenses.

This increasing burden is especially pronounced in populous counties such as Los Angeles County, CA; Cook County, IL (Chicago); and Maricopa County, AZ (Phoenix), where affordability has sharply declined. The report highlights how wages have stagnated compared to rapidly rising home prices: since early 2020, the median home price in the U.S. increased by 55.7%, while average wages rose by just 26.6%.

Read More