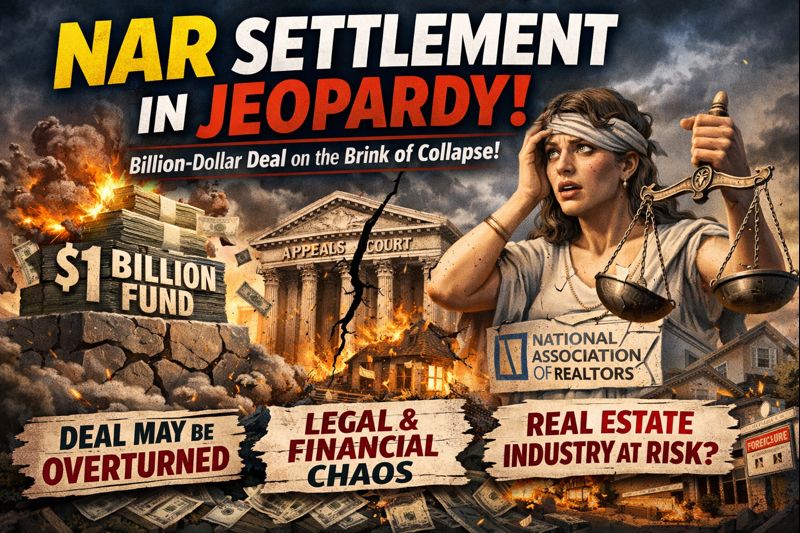

A new legal filing could blow a $1 billion hole in the National Association of Realtors’ (NAR) landmark settlement over buyer agent commissions, and set off a legal and financial chain reaction the industry hasn’t truly reckoned with.

Last week, Tanya Monestier, a law professor and class member in the Sitzer/Burnett case, filed her reply brief in the 8th Circuit Court of Appeals. Her aim? To convince the court to vacate the settlement that promised modest payouts to home sellers and minor rule tweaks by NAR. Based on her arguments, she may have a real shot.